[ad_1]

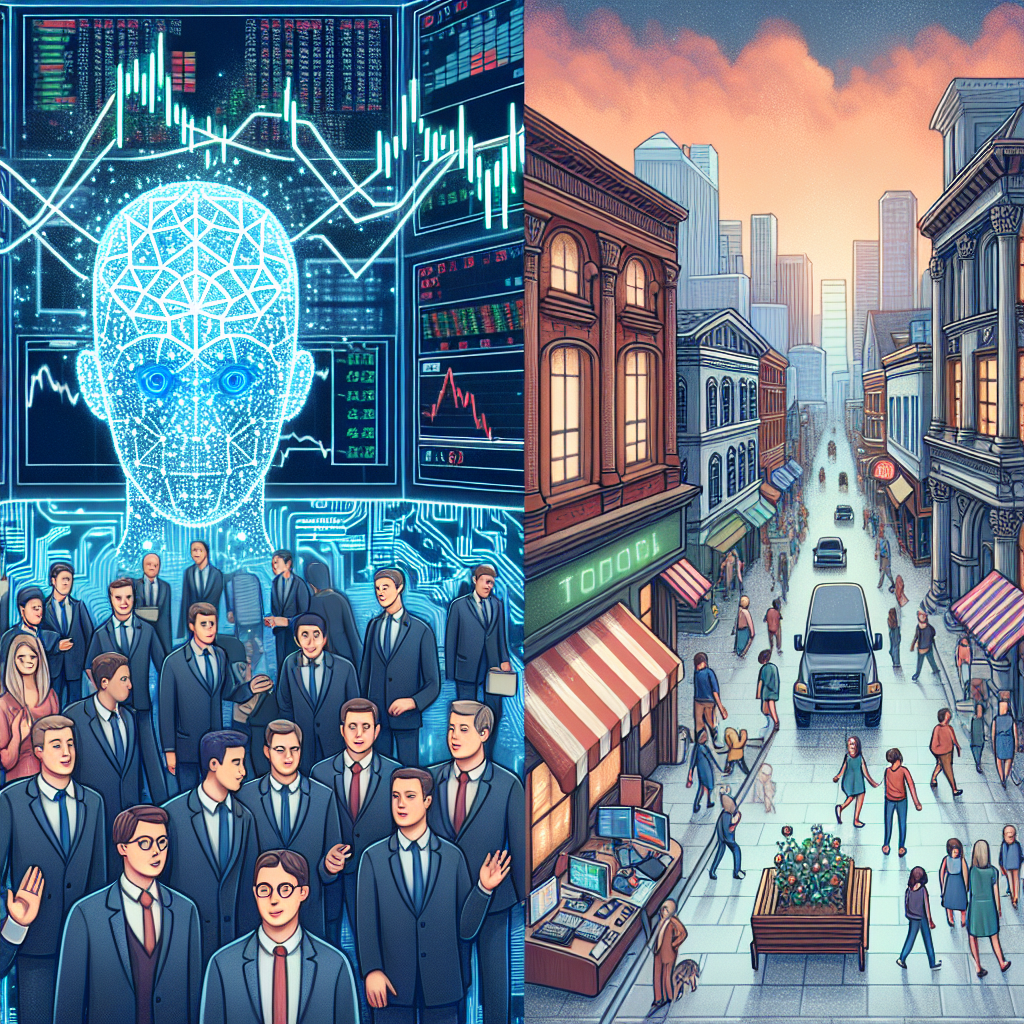

Artificial Intelligence (AI) is revolutionizing the financial trading industry, with implications that extend from Wall Street to Main Street. In recent years, AI-powered algorithms have become increasingly ubiquitous in financial markets, enabling traders to make more informed decisions and execute trades with greater efficiency and accuracy than ever before.

AI-driven trading strategies are reshaping the landscape of financial markets, bringing new opportunities for traders and investors alike. This article explores the impact of AI on financial trading and how it is changing the game for everyone involved.

The Rise of AI in Financial Trading

AI has long been utilized in various industries to streamline processes, automate tasks, and enhance decision-making. In financial trading, AI algorithms have the ability to analyze vast amounts of data in real-time, identify patterns, and predict market trends with a level of accuracy that human traders simply cannot match.

With advancements in machine learning and deep learning technologies, AI-powered trading systems are able to adapt and evolve over time, continuously improving their performance and staying ahead of ever-changing market conditions. This capability has made AI a game-changer in financial trading, giving traders a competitive edge in a rapidly evolving marketplace.

Benefits of AI in Financial Trading

The adoption of AI in financial trading offers a multitude of benefits for both traders and investors. Some of the key advantages include:

- Improved Decision-making: AI algorithms can process large amounts of data quickly and accurately, enabling traders to make more informed decisions based on real-time market information.

- Enhanced Efficiency: AI-powered trading systems can execute trades with lightning speed, reducing the risk of manual errors and maximizing trading opportunities.

- Risk Management: AI algorithms can analyze market conditions and forecast potential risks, helping traders to mitigate losses and protect their investments.

- Performance Optimization: AI can optimize trading strategies based on historical data and market trends, improving profitability and overall performance.

Challenges and Considerations

While the benefits of AI in financial trading are undeniable, there are also challenges and considerations that traders must take into account when implementing AI-powered strategies. These include:

- Data Quality: AI algorithms rely on high-quality data to make accurate predictions. Traders must ensure that the data feeding into their algorithms is clean, up-to-date, and reliable.

- Regulatory Compliance: The use of AI in financial trading raises regulatory concerns related to transparency, accountability, and fairness. Traders must navigate regulatory requirements to ensure compliance with industry standards.

- System Security: AI-powered trading systems are susceptible to cyber threats and hacking attacks. Traders must implement robust security measures to protect their AI algorithms and sensitive data.

- Human Oversight: While AI can enhance decision-making and efficiency, human oversight is still essential to ensure that trading strategies align with overall business objectives and risk tolerance levels.

Conclusion

AI is transforming the financial trading industry, enabling traders to harness the power of data and technology to make smarter, faster, and more profitable trading decisions. From Wall Street to Main Street, AI is changing the game for traders and investors alike, unlocking new opportunities and reshaping the future of financial markets.

FAQs

1. What is AI in financial trading?

AI in financial trading refers to the use of artificial intelligence algorithms and technologies to analyze market data, identify patterns, and predict market trends for trading purposes.

2. How does AI benefit traders in financial markets?

AI benefits traders in financial markets by improving decision-making, enhancing efficiency, optimizing performance, and managing risk more effectively than traditional trading methods.

3. What are the challenges of using AI in financial trading?

Challenges of using AI in financial trading include ensuring data quality, regulatory compliance, system security, and maintaining human oversight to ensure alignment with business objectives.

[ad_2]