[ad_1]

Cryptocurrency has revolutionized the way we perceive and use money, and its impact on the financial world continues to grow. With the rapid rise of digital currencies, it’s essential to understand the future of cryptocurrency trading and what to expect. This article will explore various aspects of cryptocurrency trading, offering insights and analysis to help you navigate the evolving landscape of digital assets.

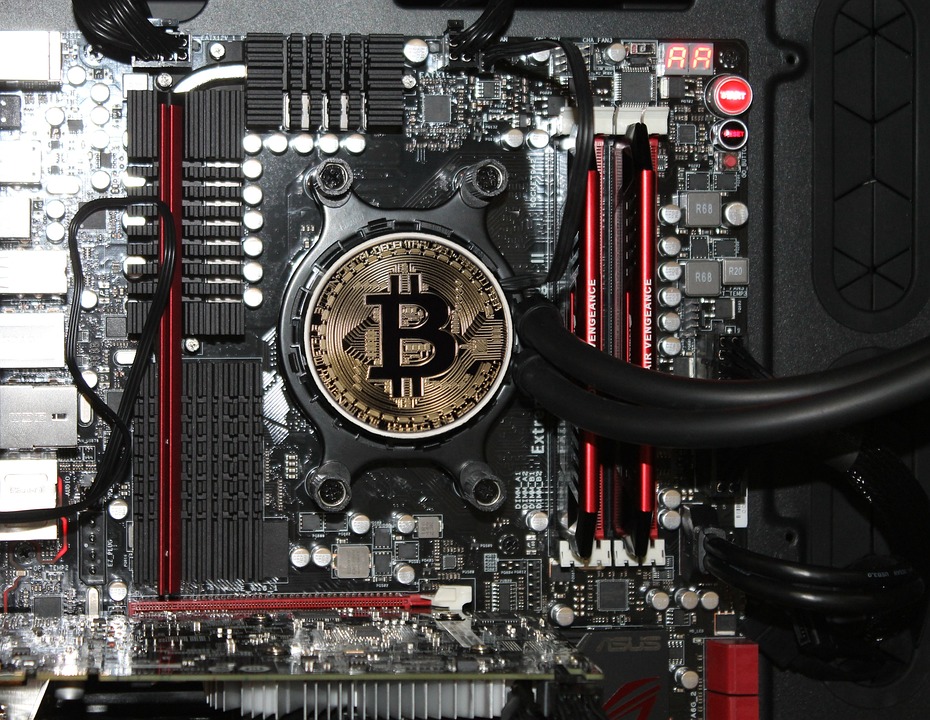

Advancements in Technology

One of the most significant factors influencing the future of cryptocurrency trading is technological advancements. As blockchain technology continues to mature and evolve, it opens up new possibilities for cryptocurrency trading. The implementation of decentralized finance (DeFi) platforms, non-fungible tokens (NFTs), and smart contracts has significantly expanded the use cases for cryptocurrencies and is likely to continue shaping the future of trading.

Technological advancements also play a crucial role in improving the security and scalability of cryptocurrency trading platforms. As the technology behind cryptocurrencies becomes more robust, it will pave the way for increased adoption and acceptance, ultimately impacting the future trading landscape.

Regulatory Environment

The regulatory environment surrounding cryptocurrency trading has been a topic of much debate and contention. As governments and financial institutions grapple with the implications of digital assets, regulations are expected to play a significant role in shaping the future of cryptocurrency trading. The establishment of clear and cohesive regulations could lead to greater mainstream adoption and integration of cryptocurrencies into traditional financial systems. Conversely, overly restrictive or ambiguous regulations could stifle innovation and limit the growth of the cryptocurrency market.

It’s important to closely monitor regulatory developments and their potential impact on cryptocurrency trading. As regulations continue to evolve, it will be crucial for traders and investors to adapt to changes and ensure compliance with the applicable laws and guidelines.

Market Volatility and Risk Management

The volatility of cryptocurrency markets is well-documented, with prices often experiencing significant fluctuations within short periods. While this volatility presents opportunities for significant gains, it also carries substantial risk. As cryptocurrency trading becomes more mainstream, there will be increased emphasis on risk management strategies to navigate the market’s inherent volatility.

Staying informed about market trends, conducting thorough research, and employing risk management tools will be essential for traders seeking to thrive in the future of cryptocurrency trading. Additionally, the development of more robust risk management solutions and derivative products tailored to cryptocurrencies is expected to help mitigate the impact of market volatility.

Integration with Traditional Financial Systems

The integration of cryptocurrencies with traditional financial systems is a key factor in shaping the future of cryptocurrency trading. As digital assets gain broader acceptance, we can expect to see increased collaboration between traditional financial institutions and cryptocurrency platforms. This integration has the potential to enhance liquidity, facilitate easier access to cryptocurrencies, and bridge the gap between fiat and digital currencies.

Furthermore, the integration of cryptocurrencies into traditional financial systems could lead to the development of innovative financial products and services, catering to both institutional and retail investors. This evolution has the potential to bring about a more cohesive and interconnected financial ecosystem, where cryptocurrencies play a pivotal role.

FAQs

What are some potential challenges in the future of cryptocurrency trading?

Potential challenges in the future of cryptocurrency trading include regulatory uncertainty, technological scalability, and security concerns. Additionally, market volatility and the need for robust risk management solutions remain significant challenges for traders and investors.

How can individuals prepare for the future of cryptocurrency trading?

Individuals can prepare for the future of cryptocurrency trading by staying informed about technological advancements, regulatory developments, and market trends. Additionally, developing a comprehensive understanding of risk management and utilizing secure, reputable trading platforms is essential for navigating the evolving landscape of cryptocurrency trading.

Conclusion

The future of cryptocurrency trading holds immense potential for growth, innovation, and widespread adoption. As technological advancements continue to drive the evolution of digital currencies, the integration of cryptocurrencies into traditional financial systems, and the establishment of clear regulations will play pivotal roles in shaping the future trading landscape. It’s crucial for traders and investors to stay informed, adaptable, and proactive in navigating the opportunities and challenges that lie ahead in the world of cryptocurrency trading.

As we move forward, embracing the myriad possibilities of cryptocurrency trading will be essential for harnessing the full potential of digital assets and ensuring their place in the future of finance.

[ad_2]